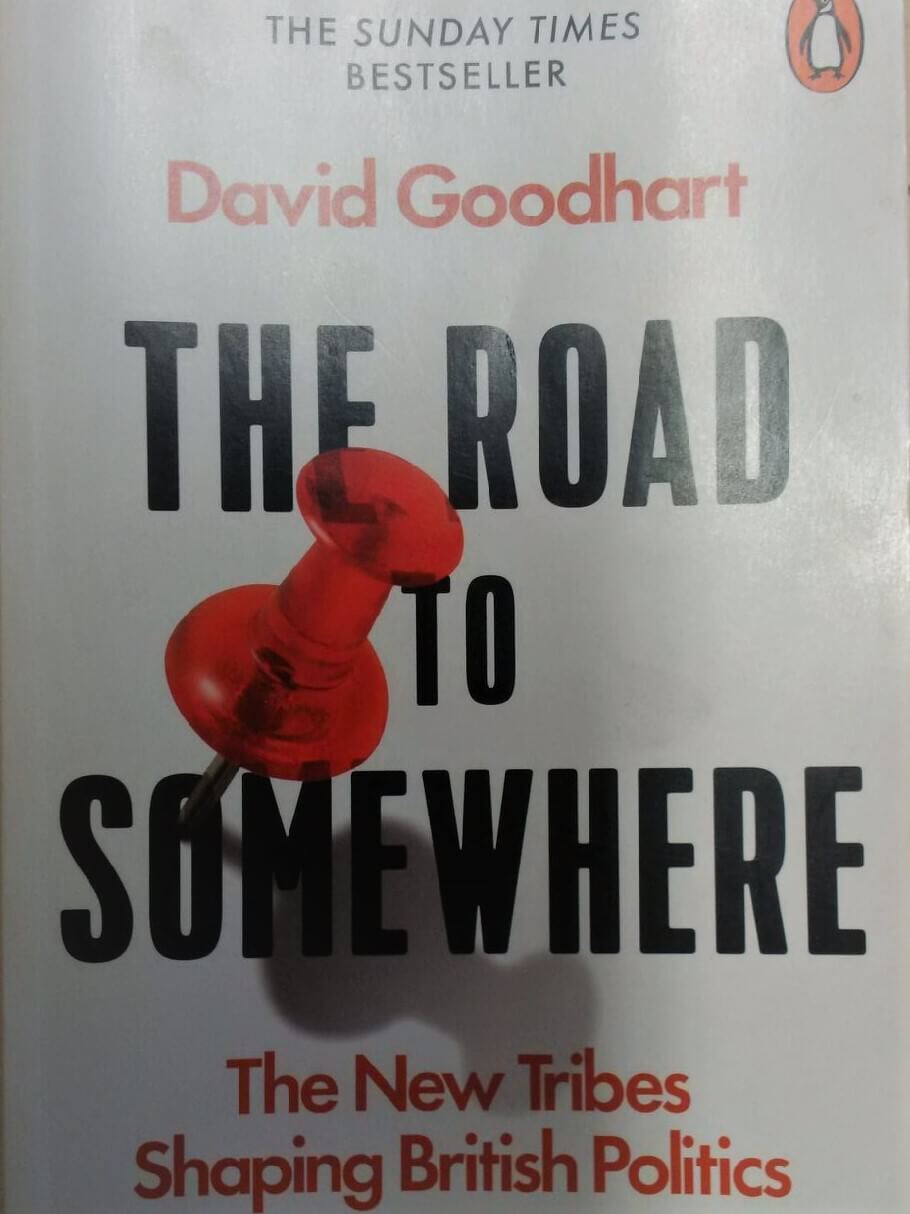

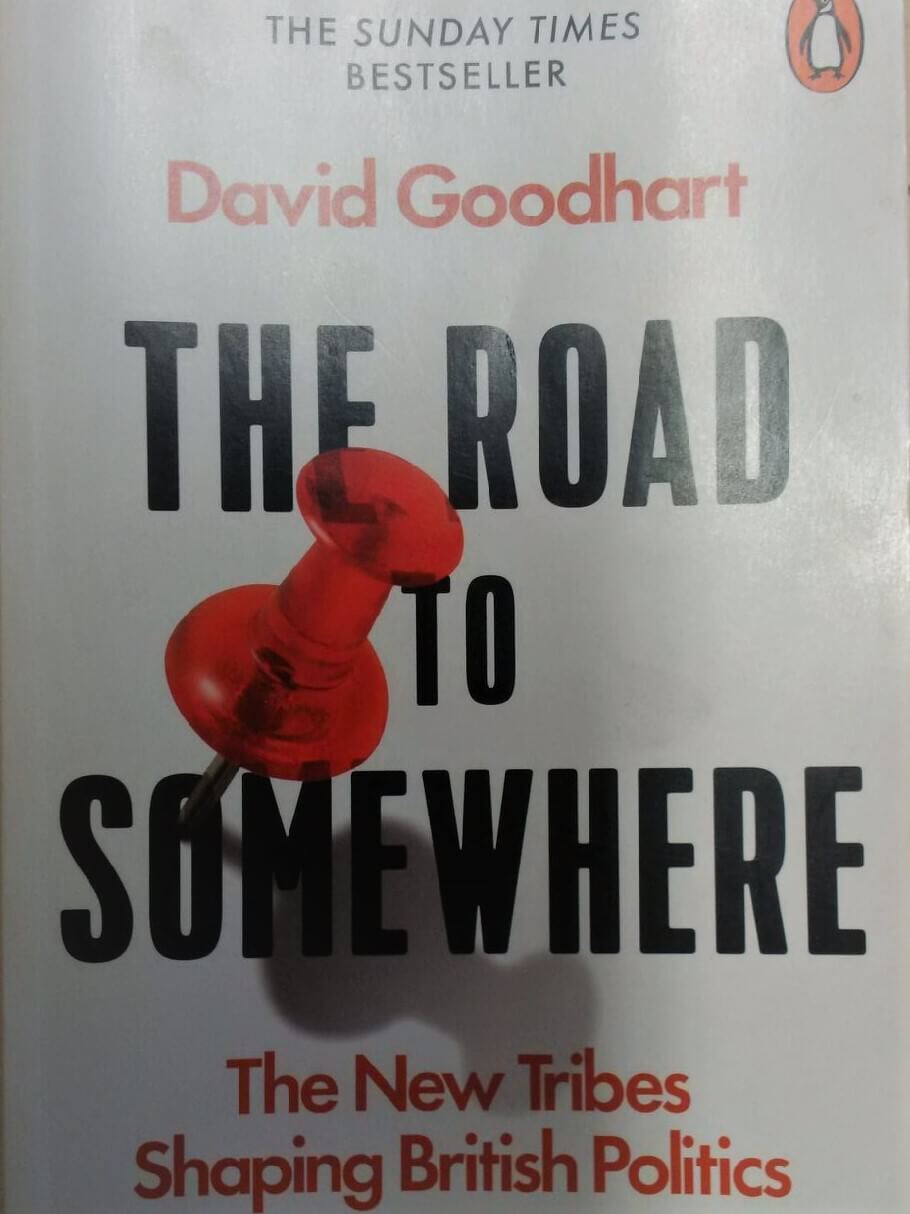

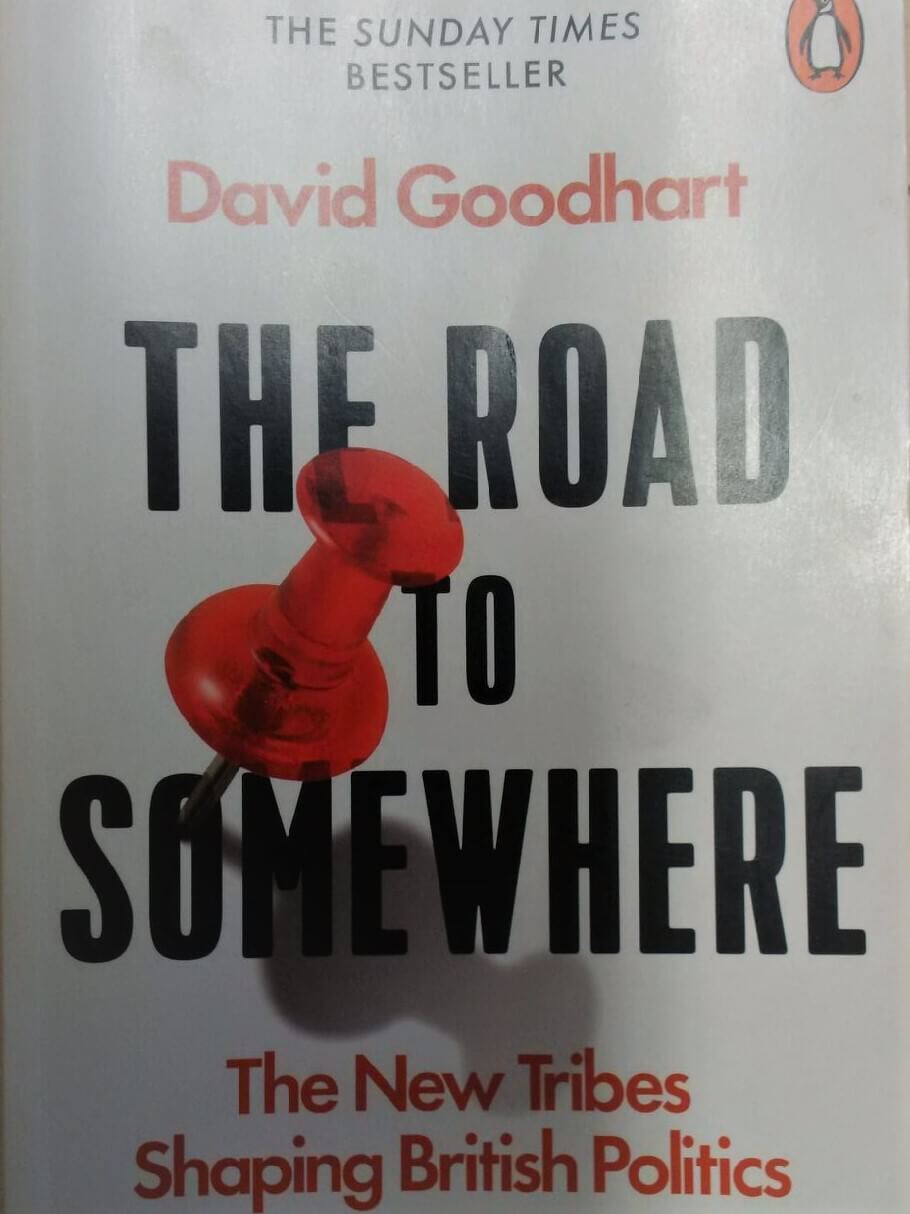

The road to somewhere

I have been reading a most interesting book* – giving a view as to why “Trump” and “Brexit” happened.

The thesis of the book (much simplified) is that those involved in:-

– the Government (politicians and civil service)

– the Press, and

– Academia

have, for many years, held a very similar, elitist and particular overview of the world.

This is a view (according to research) which matches, maybe, as little as 6% of the views of the wider population. However, the platforms which these people have, to present their views, leads to their attitudes dominating public debate.

A shorthand term, for these views, might be “political correctness”.

Any contrary view to the “correct view” soon becomes (and is firmly stated to be) “unacceptable” – notwithstanding that narrow view of what is “right” matches, maybe, just 6% of society.

Public debate, so the thesis runs, becomes constrained due to the ability of these opinion formers to dominate the debate – and to shame dissenters into silence or helpless acquiescence.

The book suggests that “Trump” and “Brexit” happened because the only place where the remaining 94% of the population were able to express their frustration was in the privacy of the ballot box – and enough of those folk were frustrated enough to deliver “Trump” and Brexit” – to the horror (and amazement) of the elite.

Why do I raise this as a “view” on a website focused on financial services regulation?

Simply because the above scenario rings very true with the sharp divide between the views of the regulators of financial services and those whose job it is to deliver financial services – and who must make a reasonable profit whilst doing so.

Although the FCA has three statutory objectives:-

– a consumer protection objective: to secure an appropriate degree of protection for consumers;

– an integrity objective: to protect and enhance the integrity of the UK financial system; and

– a competition objective: to promote effective competition in the interests of consumers in the markets for regulated financial services

the headline thrust from the FCA is always consumer focused – to the point where the regulator will now even question the “value” of insurance in a market economy.

I would suggest that the FCA needs to be very careful.

Consumers depend upon a vibrant and confident (albeit well regulated) financial services sector. The view of Government, the Press and Academia is that this vibrancy will be delivered by focus on the consumer, based on a narrow and particular view as to consumer attitudes to price and need.

The platform (and power) which the FCA has to promote these views generates that same “political correctness” which has trade associations and other industry bodies (largely) acceding to the view – because to talk about balance, and maybe even sustainable profit, is fast becoming “unacceptable”.

Because this “consumerist” agenda has the full weight of government support we have the prospect of a scenario equivalent to the “Trump” and “Brexit” outcomes occurring. This is a scenario where the opinion formers become detached from the reality of a world which lies outside their narrow view – and those who occupy the real world stay silent as to the consequences – until it is too late.

* David Goodhart – The Road to Somewhere (Pan Books)